Errors in credit checks significantly impact the rental application process, hindering qualified applicants from securing accommodation and causing delays for landlords. Accurate financial documentation and data handling are crucial to ensure fairness, avoid wrongful denials, and mitigate administrative burdens. Navigating legal obligations related to checks is vital for landlords and tenants to foster healthy relationships and maintain compliance, smoothing the renting process.

“Uncovering the hidden costs: Exploring the implications of check errors on rental applications. In today’s stringent rental market, a simple check error can significantly affect your chances of securing a property. This article delves into the intricate web of how these errors influence rental decisions, examining tenant creditworthiness as the pivotal factor. From common mistakes to legal obligations, we dissect the consequences and provide insights to help both tenants and landlords navigate this crucial aspect of renting with confidence.”

- How Check Errors Affect Rental Decisions

- Tenant Creditworthiness: The Key Consideration

- Common Types of Check Mistakes and Their Consequences

- Navigating Legal Obligations in Renting

How Check Errors Affect Rental Decisions

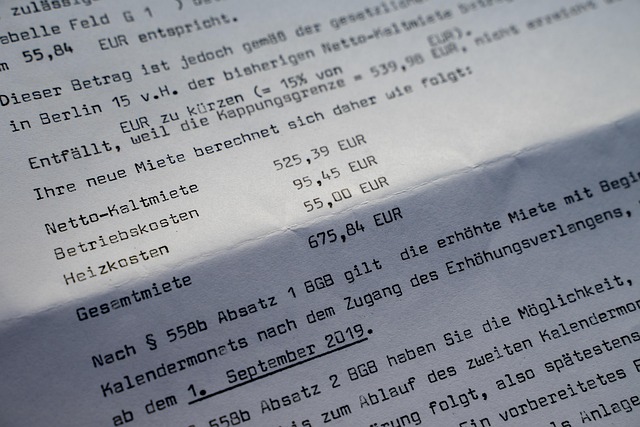

Check errors, especially on rental applications, can significantly impact an individual’s ability to secure accommodation. Landlords and property managers use credit checks as a crucial tool to assess potential tenants’ financial reliability. Any discrepancies or errors in these reports may lead to adverse decisions. For instance, a simple data entry mistake could result in an applicant being denied due to perceived financial instability.

These errors can have long-lasting consequences, causing applicants to miss out on desirable rental properties and potentially delaying their housing search. Inaccurate check information might also create unnecessary stress and frustration for tenants who are otherwise qualified. Therefore, it’s essential to double-check all details and ensure the accuracy of financial documentation to avoid these negative implications when applying for rentals.

Tenant Creditworthiness: The Key Consideration

The impact of check errors on rental applications cannot be overstated, as they play a pivotal role in determining tenant creditworthiness. Landlords and property managers often rely on background checks to assess potential tenants’ financial stability and responsible behavior. Accurate check results provide insights into an individual’s payment history, enabling landlords to make informed decisions about renting their properties.

When errors occur in these checks, it can significantly skew the assessment of a tenant’s creditworthiness. Incorrect information may lead to unqualified individuals securing rental agreements or, conversely, qualified applicants being wrongly denied. This underscores the importance of meticulous data handling and cross-validation during the check process to ensure fairness and accuracy in evaluating potential tenants.

Common Types of Check Mistakes and Their Consequences

Common types of check mistakes, such as incorrect routing numbers, insufficient funds, and typos in account details, can have significant implications for both tenants and landlords. When a check is returned due to any of these reasons, it reflects poorly on the tenant’s reliability and financial discipline, which can affect their chances of securing future rentals. Moreover, each bounced check may incur additional fees from the bank, further straining the tenant’s finances or causing misunderstandings with the landlord.

For landlords, frequent check errors can lead to delays in rent collection, potentially impacting cash flow management and increasing administrative burdens. They may need to invest time and resources into tracking down tenants who consistently provide invalid checks, leading to a less efficient rental experience for all parties involved. The impact of checks on renting extends beyond individual cases; repeated issues can erode trust within the rental market, emphasizing the importance of meticulous checkwriting and clear communication.

Navigating Legal Obligations in Renting

Navigating the legal obligations in renting is crucial, especially when considering the impact of checks on the application process. Landlords and property managers have a responsibility to ensure fair and transparent practices when screening potential tenants. This includes understanding the laws surrounding credit and background checks, which vary by region. In many places, landlords must adhere to strict guidelines regarding what information can be requested and how it is used in decision-making.

The impact of check errors on renting cannot be understated. Mistakes in these evaluations can lead to unfair rejections or delays for qualified applicants. It’s essential for both parties to remain informed about their rights and the legal boundaries set by these checks. By understanding these obligations, landlords can create a smoother process, fostering a healthier relationship with potential tenants and ensuring compliance with relevant regulations.